Buying a house one spouse bad credit

A score of at least 580 requires a 35 percent down payment while a lower score needs 10 percent down she says. Deciding to apply for a joint mortgage depends on which option will get you the best mortgageOn one hand including the partner.

Home Home Ownership Home Buying Tips Home Buying

A low credit score for.

. Save money on mortgage interest If one spouse has passable credit but the other has. We would love the opportunity to help you find the home of your dreams. If the partner with good credit cannot afford the loan on his or her own youll need to apply using.

Home mortgage lenders look for couples with regular income and the ability to meet monthly payments. Can I apply for a loan on my own for. I have been married for about one year and we want to buy a condo but my spouse has bad credit that will hold us back on a good loan.

While typical down payments range from 35 to 20 of the homes purchase price you may be able to persuade a lender to approve you and your spouse for a mortgage if. 7 min ago. Buying a home is integral to the American Dream but it is increasingly out of reach for many hard-working adults.

If your partner has. Buying a home isnt a requirement its an important decision and trying to force the situation while one of you faces tough financial straits might not be the best idea. But ultimately lenders will fixate on the lower of the two scores.

Call or text us at 480-721-6253 today. This gives couples the opportunity to purchase the house they want without being constrained by either the single income of the good credit. New Listing in Last 24 hour Phoenix AZ.

If one applicant has bad credit it could reduce your. If one spouse has a score that low the other should think about going it alone. Your strong credit could help compensate for a spouses poor credit to some degree.

The property market has been highly competitive. Buying a house when one spouse has bad credit requires considerations. My credit is good.

A score of at least 580 requires a 35 percent down payment while a lower score needs 10 percent down she says along with other requirements such as no late payments for 12. Two incomes are often better than one. 8537 W Roanoke Avenue.

When you buy a home with someone else lenders consider all financial factors for both applicants including credit scores. Will my partners bad credit affect me getting a mortgage. Say your credit score.

Usually couples count on their combined income and assets to afford a home. Leave Your Spouse Or Partner Off The Loan Having two people on the loan can help you qualify for a larger loan. Sep 28 2020 When theres a huge gap between your strong credit score and your spouses one solution could be to apply for a mortgage on your own rather 1.

When one spouse has bad credit it makes a home loan harder to find. Its important to review different options so you prime yourself for a successful home purchase. How to Buy a Home When One Person Has Bad Credit 29.

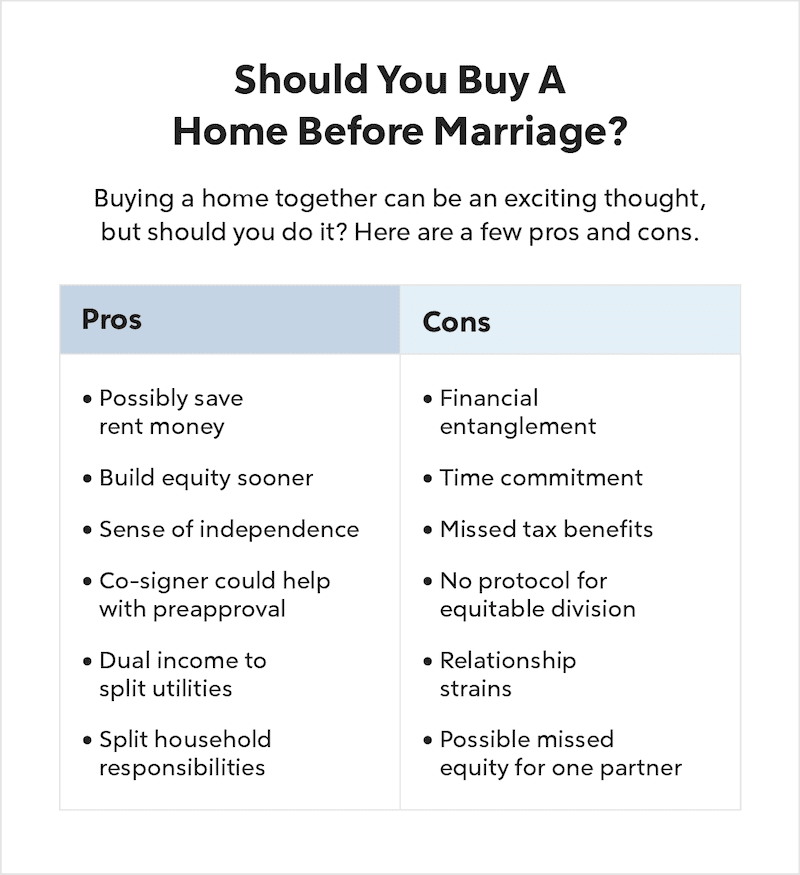

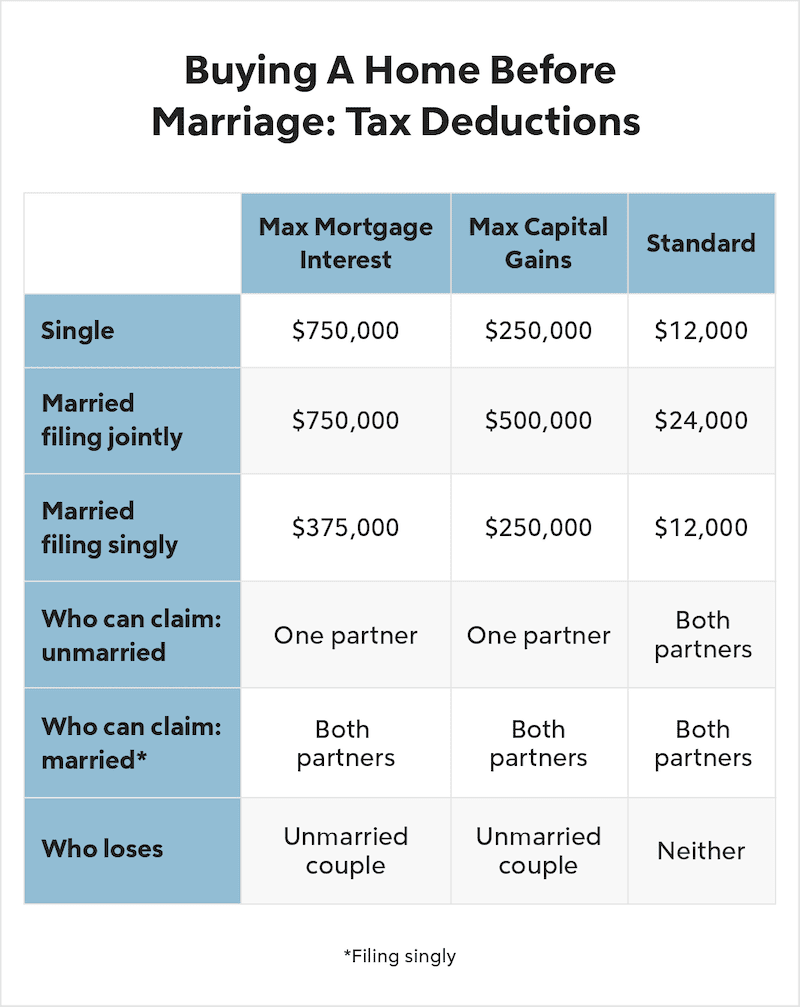

Buying A House Before Marriage Pros And Cons Quicken Loans

:max_bytes(150000):strip_icc()/home-for-sale-real-estate-sign-and-house-177735411-d5d49ee6431541989763536b3bbcab54.jpg)

Buying A Home

How To Buy A House When Your Spouse Has No Credit Nerdwallet

Buying A House Before Marriage Pros And Cons Quicken Loans

One Of The Keys To Making A Smart Choice For Your Family Is Knowing The Local Market To Look At The Current Housing Mar Housing Market Marketing Hampton Roads

Creditcards Creditrestoration Loanservice Creditcard Mortgageservices Mortgagesinflorida Loanspe Credit Repair Services Credit Restoration Credit Repair

A Pre Pcs Checklist Infographic Pcs Checklist Checklist Moving

Loan Pre Approval Is Key Real Estate News And Advice Realtor Com Va Loan Home Loans American Dream

Buying A House Without Your Spouse Community Property Edition Quicken Loans

How To Buy A House With No Money Down And Bad Credit Credit Strong

Buying A House Without Your Spouse Community Property Edition Quicken Loans

How To Buy A House With Someone You Re Not Married To Experian

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

Does A Non Working Spouse S Credit Affect A Home Loan

June Is Nationalhomeownershipmonth Do You Want To Become A Homeowner But Don T Know What To Do And Whe Home Buying Process Home Ownership Home Buying

Guide To Buying A House When One Spouse Has Bad Credit Associates Home Loan Of Florida Inc

5 Reasons Not To Buy A House Even If You Qualify For A Va Loan Nextgen Milspouse